Accounts Receivable Certification Course

Accounts Receivable Certification Course - Learn the accounts receivable cycle. Introduction to finance and accounting: You will then learn how to code financial transactions in financial accounting language. Learn how to prevent fraud in your accounts receivable department. Training benefits apply current accounts receivable management techniques If you would like to earn an honors badge on your certificate for this course, you must complete a. Web accounts receivable (ar)/accounts payable (ap) — most of these professionals hone their skills on the job, but an accounts receivable/payable certification can help move you up in the job ranks. Web this course demonstrates theoretical and practical core topics and introduces excel for managing accounts receivable. Whether managing piggy banks or portfolios, ou. Who should attend this course is designed for ceos, cfos, senior managers, sales managers, accounting staff. Web in this course, you will learn foundations of financial accounting information. Web enroll in our course today and become an accounts receivable expert quickly. Whether managing piggy banks or portfolios, ou. Web learn accounts payable and receivable management, inventory classification, cost tracking, and budget creation using tallyprime. Learn the accounts receivable cycle. Web this course is for those interested in starting a career in bookkeeping. Accounting, financial accounting, financial analysis, general accounting, decision making, cash management, finance, cost accounting, generally accepted accounting principles (gaap), management accounting. Develop effective credit policies that meet a company’s objectives Learn multiple methods to increase your turnover and speed up collections. Web here’s our list of the. Course objectives by the end of the course, participants will be able to: You can enroll online or click here to book an enrolment session with one of our trusted advisors. 7 videos 2 readings 6 quizzes. Accounting, financial accounting, financial analysis, general accounting, decision making, cash management, finance, cost accounting, generally accepted accounting principles (gaap), management accounting. Lastly, we. Accounts receivable management this ar course will be covering many important topics such as 1. Accounting, financial accounting, financial analysis, general accounting, decision making, cash management, finance, cost accounting, generally accepted accounting principles (gaap), management accounting. Explore the full certification list here for prices, links, and other details. Accredited receivables specialist (ars) registration fee: In the meantime, you will learn. You are not required to be a member to enroll.) You will then learn how to code financial transactions in financial accounting language. Web this course demonstrates theoretical and practical core topics and introduces excel for managing accounts receivable. These courses cover topics such as billing, collections, credit management, and dispute resolution. Web in summary, here are 10 of our. Learn industry recommended accounts receivable procedures and best practices. Receive training from an accounts receivable professional with 30+ years of experience. Navigate the financial spectrum with confidence! Course objectives by the end of the course, participants will be able to: Accounting, financial accounting, financial analysis, general accounting, decision making, cash management, finance, cost accounting, generally accepted accounting principles (gaap), management. ‘accounts receivable’ (ar) refers to the money a business is owed by its customers for goods or services it has provided on credit. Learn multiple methods to increase your turnover and speed up collections. Training benefits apply current accounts receivable management techniques Accounting, financial accounting, financial analysis, general accounting, decision making, cash management, finance, cost accounting, generally accepted accounting principles. These courses cover topics such as billing, collections, credit management, and dispute resolution. Web here’s our list of the best certifications available to accounts receivable managers today. Lastly, we will discuss notes receivable and various methods of financing with receivables. 7 videos 2 readings 6 quizzes. Learn best practices for accounts receivable. Accredited receivables specialist (ars) registration fee: Navigate the financial spectrum with confidence! Web enroll in our course today and become an accounts receivable expert quickly. These courses cover topics such as billing, collections, credit management, and dispute resolution. In the meantime, you will learn about the most. Web accounts receivable (ar) training and certification courses provide individuals with the knowledge and skills necessary to effectively manage accounts receivable. Ar professionals can earn accredited receivables manager (arm) or accredited receivables specialists (ars) certifications, while ap professionals opt. In the meantime, you will learn about the most. Learn best practices for accounts receivable. ‘accounts receivable’ (ar) refers to the. 7 videos 2 readings 6 quizzes. Web here’s our list of the best certifications available to accounts receivable managers today. You will start your journey with a general overview of what financial accounting information is and the main financial statements. You will then learn how to code financial transactions in financial accounting language. Certified accounts receivable professional (carp) certified accounts receivable professional (carp) is a professional designation offered by the national association of credit management (nacm). Learn industry recommended accounts receivable procedures and best practices. Web this course demonstrates theoretical and practical core topics and introduces excel for managing accounts receivable. Bookkeeper, accounting clerk, accounts payable specialist Accounts receivable management this ar course will be covering many important topics such as 1. Whether managing piggy banks or portfolios, ou. Introduction to finance and accounting: Course objectives by the end of the course, participants will be able to: Accredited receivables specialist (ars) registration fee: Web next, we will introduce the approaches to estimate bad debt expense related to accounts receivable. Learn multiple methods to increase your turnover and speed up collections. Lastly, we will discuss notes receivable and various methods of financing with receivables.

Accounts Receivable Training Course for Working Professionals

WATCH Accounts Payable And Accounts Receivable Aplos Training Center

Accounts Receivable SAP FICO Training & Certification an SAP

Accounts Receivable Training Course for Working Professionals

SAP Accounts Receivable Training SAP Accounts receivable complete

SAP Accounts Receivable (basic to advanced) Training & Certification

Accounts Receivable Training Course Academy of Business Training

Accounts Receivable Certification Institute of Finance & Management

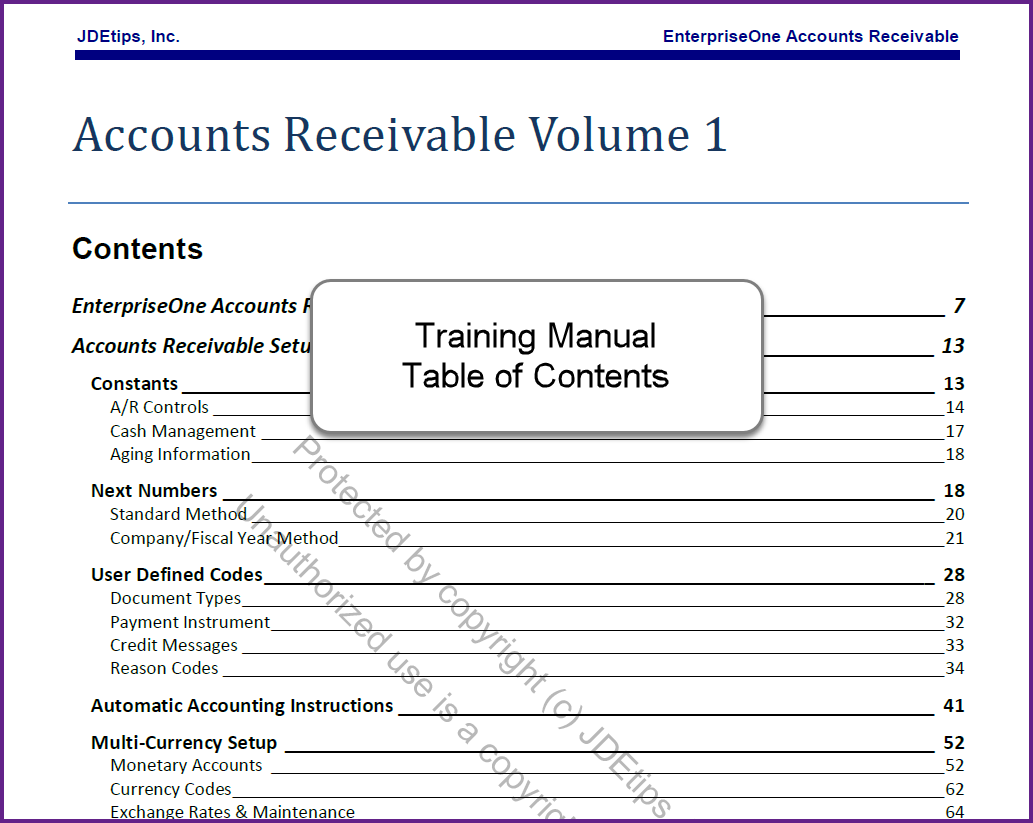

JD Edwards Accounts Receivable Training

Online Accounts Payable and Receivable Certificate Course Australia

Navigate The Financial Spectrum With Confidence!

Web In This Course, You Will Learn Foundations Of Financial Accounting Information.

‘Accounts Receivable’ (Ar) Refers To The Money A Business Is Owed By Its Customers For Goods Or Services It Has Provided On Credit.

If You Would Like To Earn An Honors Badge On Your Certificate For This Course, You Must Complete A.

Related Post: