Afsp Course

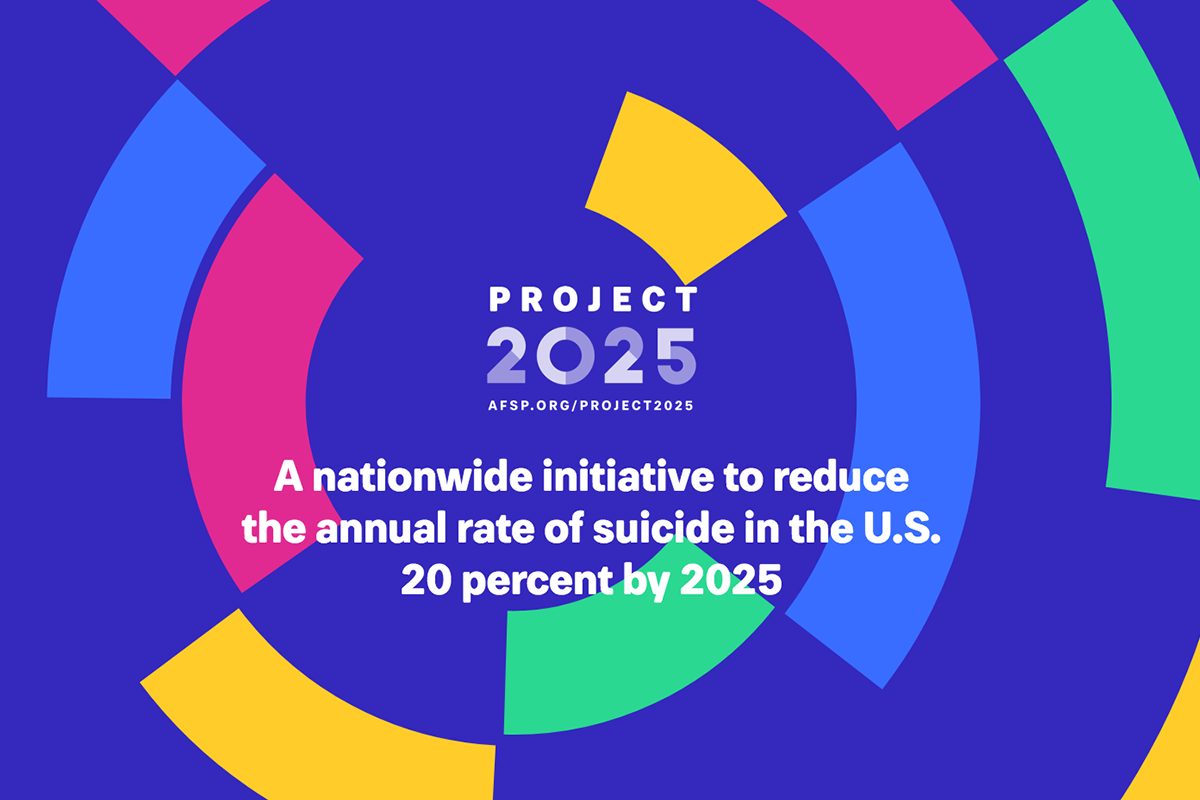

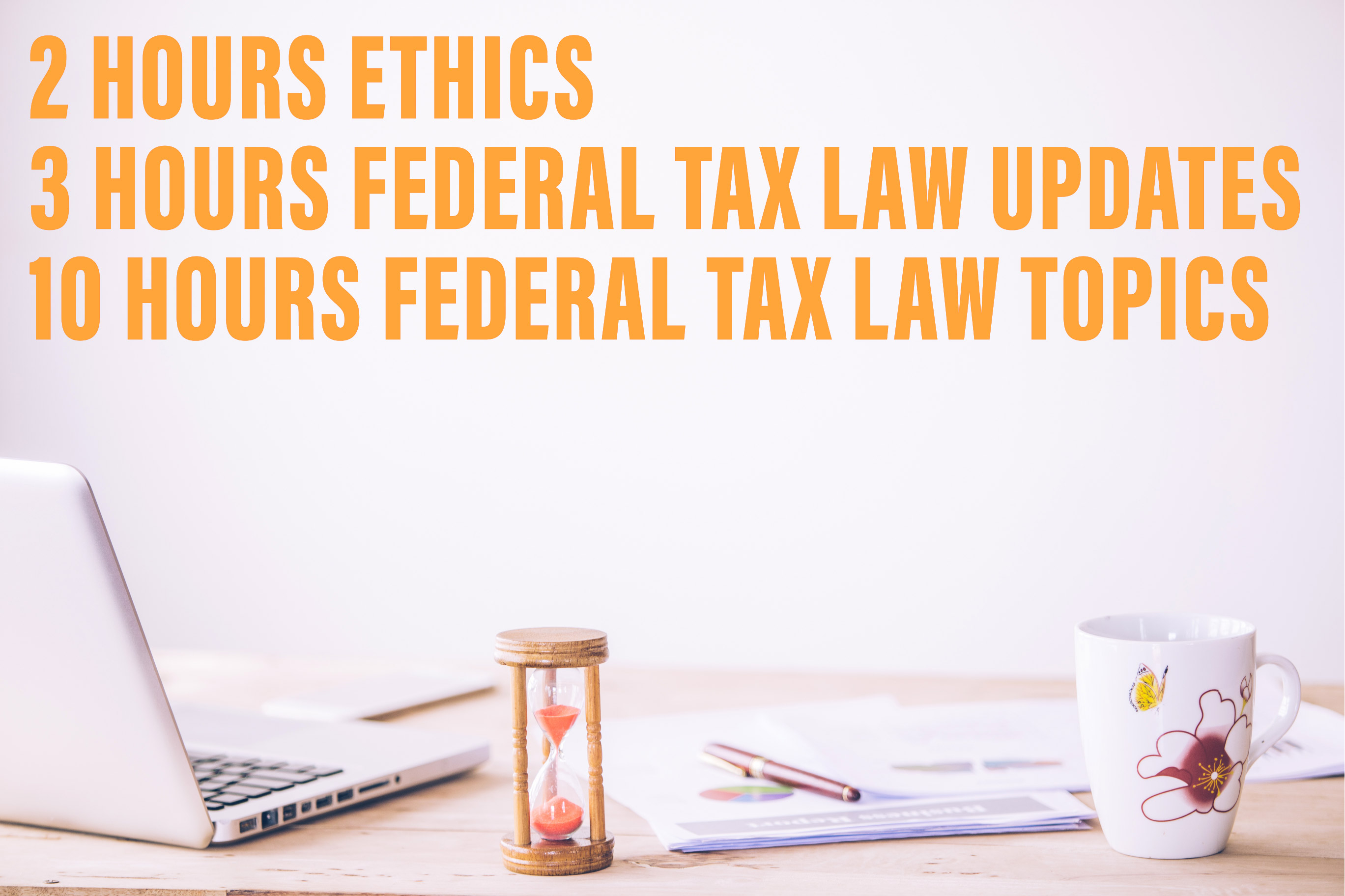

Afsp Course - 10 hours of federal tax law. Unenrolled return preparers can elect to voluntarily demonstrate completion of basic 1040 filing season tax preparation and other tax law training through continuing education. Those who choose to participate can meet the requirements by obtaining 18 hours of continuing education, including a six hour federal tax law refresher course with test. The 6 hour aftr course is limited to 6 attempts). Gehnz) complete your afsp ce requirements with annual federal tax refresher (aftr) course, covering all required subject areas. Earn your record of completion and become eligible to be listed in the official database for 2024. Top rated irs approved ce provider. Supporting afsp allows the organization to continue its important work to help save lives and bring hope to those affected by suicide. Fast forward academy afsp course; Web we provide all students with tax updates throughout the year on our platinum blog site (*note: Wiseguides afsp course #1 lambers afsp courses The first question that you may have is the easiest one to answer. Earn your record of completion and become eligible to be listed in the official database for 2024. Web get unlimited access to our extensive library of afsp courses, including aftr course. 10 hours of other federal tax law topics; Fast forward academy afsp course; Web the irs's annual filing season program (afsp) aims to recognize the efforts of tax return preparers who aspire to a higher level of professionalism. Web get unlimited access to our extensive library of afsp courses, including aftr course. Wiseguides afsp course #1 lambers afsp courses Earn your record of completion and become eligible to. 10 hours of federal tax law. Those who choose to participate in this year’s program can meet the requirements by obtaining specified hours of continuing education and meeting certain other guidelines prior to the upcoming. Top rated irs approved ce provider. Although this is a voluntary program, you do not want to dismiss it as unnecessary. 3 hours of federal. The 6 hour aftr course is limited to 6 attempts). Web the irs annual filing season program (afsp) is very important. Web the 2023 annual filing season program (afsp) renewal season begins! Afsp focuses on support, advocacy, research and education initiatives to raise. It stands for the irs annual filing season program. Web these are the top 5 best afsp courses in 2024: Web the 2023 annual filing season program (afsp) renewal season begins! Web save lives and bring hope. Afsp focuses on support, advocacy, research and education initiatives to raise. Web the irs annual filing season program (afsp) is very important. Top rated irs approved ce provider. Increased tax knowledge differentiate yourself in the marketplace with afsp credentials 3 hours of federal tax law updates, 10 hours of other federal tax law topics and; Web we provide all students with tax updates throughout the year on our platinum blog site (*note: The first question that you may have is the easiest. Web the annual filing season program is intended to recognize and encourage unenrolled tax return preparers who voluntarily increase their knowledge and improve their filing season competency through continuing education (ce). Earn your record of completion and become eligible to be listed in the official database for 2024. Those who choose to participate in this year’s program can meet the. Web the irs's annual filing season program (afsp) aims to recognize the efforts of tax return preparers who aspire to a higher level of professionalism. 10 hours of federal tax law. Although this is a voluntary program, you do not want to dismiss it as unnecessary. The irs annual filing season program (afsp) is an annual voluntary irs training program. Those who choose to participate in this year’s program can meet the requirements by obtaining specified hours of continuing education and meeting certain other guidelines prior to the upcoming. It stands for the irs annual filing season program. Those who choose to participate can meet the requirements by obtaining 18 hours of continuing education, including a six hour federal tax. Added benefits of this program are: The first question that you may have is the easiest one to answer. Web i meet one of these exemptions. Web get unlimited access to our extensive library of afsp courses, including aftr course. 10 hours of other federal tax law topics; Web for further information or inquiries, email illinois@afsp.org. Web i meet one of these exemptions. Web afsp course providers is afsp right for you with so many gems to uncover, let’s dig right in! Afsp focuses on support, advocacy, research and education initiatives to raise. It stands for the irs annual filing season program. Web save lives and bring hope. Those who choose to participate can meet the requirements by obtaining 18 hours of continuing education, including a six hour federal tax law refresher course with test. The annual filing season program is a voluntary program designed to encourage tax return preparers to participate in continuing education (ce) courses. Added benefits of this program are: Supporting afsp allows the organization to continue its important work to help save lives and bring hope to those affected by suicide. Top rated irs approved ce provider. Many people’s introduction to afsp comes through the out of the darkness walks, taking place in cities nationwide. Web the irs annual filing season program (afsp) is very important. Although this is a voluntary program, you do not want to dismiss it as unnecessary. Fast forward academy afsp course; The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers.

🥇 Where to Find the Best AFSP Prep Courses in 2024

AFSP and SafeSide Prevention

AFSP course Writing a Policy Memo

AFSP IRS Approved Continuing Education AFSP

IRS AFSP Certificate Course Groupon

Interview with Maggie Mortali for AFSP’s Interactive Screening Program

![Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]](https://ipassthecpaexam.com/wp-content/uploads/2020/08/ipassthecpaexam.com1_.png)

Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]

AFSP Online Tax Course

AFSP IRS Approved Continuing Education AFSP

Afsp Online Course INFOLEARNERS

The 6 Hour Aftr Course Is Limited To 6 Attempts).

Wiseguides Afsp Course #1 Lambers Afsp Courses

Unenrolled Return Preparers Can Elect To Voluntarily Demonstrate Completion Of Basic 1040 Filing Season Tax Preparation And Other Tax Law Training Through Continuing Education.

Web These Are The Top 5 Best Afsp Courses In 2024:

Related Post: