Annual Filing Season Program Online Courses

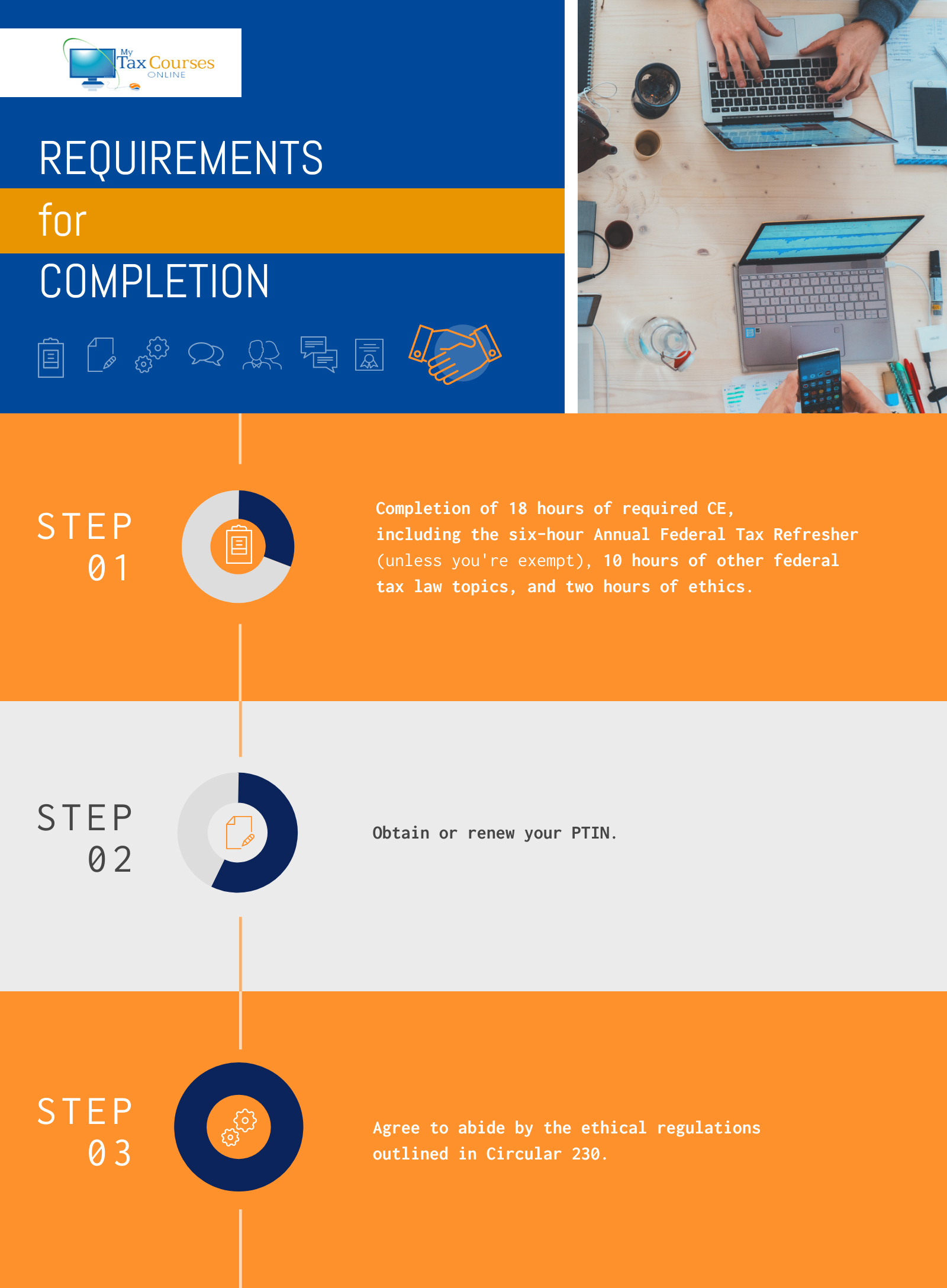

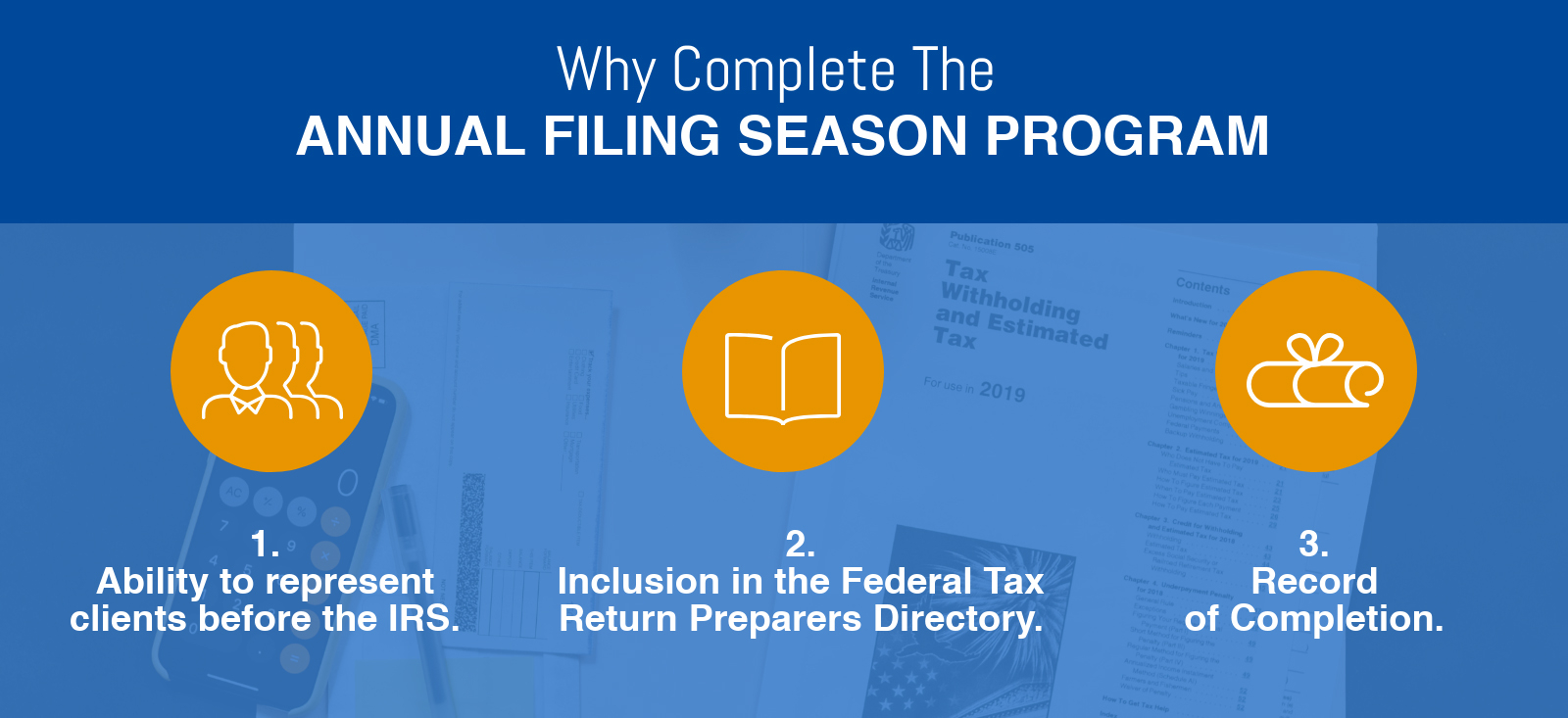

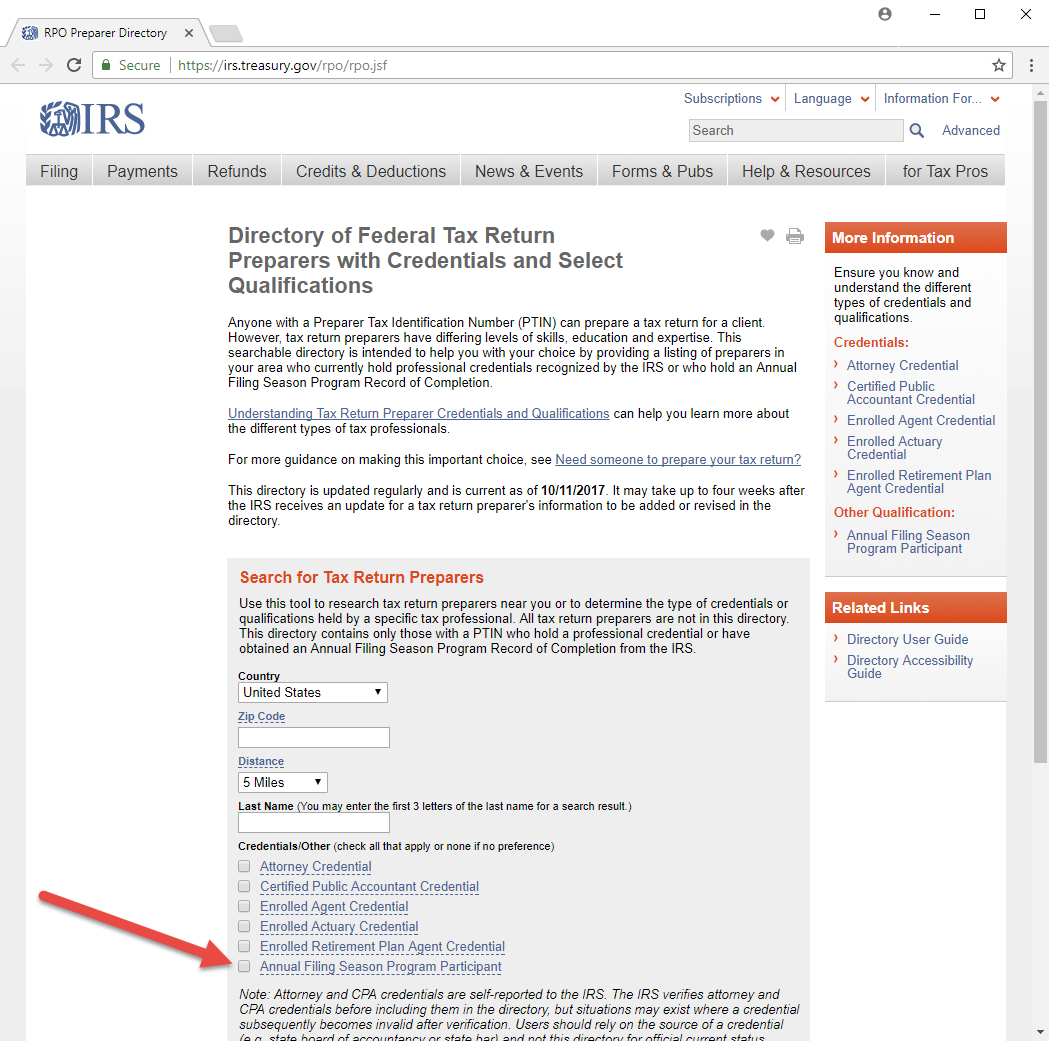

Annual Filing Season Program Online Courses - Ready to enroll in one of our irs afsp packages? Web annual filing season program record of completion 1. Web what are the requirements to achieve annual filing season program completion? #1 lambers annual filing season program course pros wide reaching content: Once you have your documentation, follow these steps: Click the use free guided tax preparation. The easiest way is to buy a package like ours. If you are an unenrolled tax return preparer you must complete the 6 hour irs annual federal tax refresher course (aftr) along with your ce to receive an. Will the afsp record of completion indicate the filing season (calendar year) for which it was issued? Six (6) hours of credit for the annual federal tax. Six (6) hours of credit for the annual federal tax. Set yourself apart from the competition! Lambers’ continuing education courses cover a wide range of content for anyone who works with taxes. Web take this course to participate in continuing education (ce) courses and earn limited representation rights before the irs. Will the afsp record of completion indicate the filing. Web the annual filing season program (afsp) is a voluntary program that recognizes the efforts of tax preparers who are not attorneys, cpas (certified public accountants), or enrolled agents. If you are an unenrolled tax return preparer you must complete the 6 hour irs annual federal tax refresher course (aftr) along with your ce to receive an. Web afsp is. (revised 1/28/21) yes, each record of completion will clearly identify the filing season (calendar year) for which it is valid (e.g., 2021 active year for the 2021 annual filing. Web how do i complete the annual filing season program? What is mycpe unlimited access? Eighteen (18) hours of irs continuing education in the. Web each of these annual filing season. Web irs annual filing season program, online tax courses, tax school prep, getting a career, tax preparation, job security, tax preparer Web annual filing season program. What is the annual filing season program for return preparers? Web each of these annual filing season program courses are extremely effective and ordered based on their high quality learning process. Consequently, the goal. Web 10% off save now on any afsp course package! Consequently, the goal of the program is to encourage continuing education as a tax preparer. Leaders in online irs afsp tax ce The yearly requirement for exempt status tax preparers is 15 hours. Set yourself apart from the competition! If you are an unenrolled tax return preparer you must complete the 6 hour irs annual federal tax refresher course (aftr) along with your ce to receive an. (revised 1/28/21) yes, each record of completion will clearly identify the filing season (calendar year) for which it is valid (e.g., 2021 active year for the 2021 annual filing. Web annual filing. Set yourself apart from the competition! What is the annual filing season program for return preparers? #1 lambers annual filing season program course pros wide reaching content: Ten (10) hours of general federal tax law topics. Eighteen (18) hours of irs continuing education in the. Lambers’ continuing education courses cover a wide range of content for anyone who works with taxes. Once you have your documentation, follow these steps: Those who choose to participate can meet the requirements by obtaining 18 hours of continuing education, including a six hour federal tax law refresher course with test. Web irs annual filing season program, online tax courses,. Web the annual filing season program (afsp) is a voluntary program that recognizes the efforts of tax preparers who are not attorneys, cpas (certified public accountants), or enrolled agents. It stands for the irs annual filing season program. If you are an unenrolled tax return preparer you must complete the 6 hour irs annual federal tax refresher course (aftr) along. Web take this course to participate in continuing education (ce) courses and earn limited representation rights before the irs. Web annual filing season program record of completion 1. Click the use free guided tax preparation. The yearly requirement for exempt status tax preparers is 15 hours. Web your 2021 tax return to access your adjusted gross income. Eighteen (18) hours of irs continuing education in the. Web take this course to participate in continuing education (ce) courses and earn limited representation rights before the irs. Web the annual filing season program will be an interim step to help taxpayers and encourage education for unenrolled tax return preparers. Set yourself apart from the competition & demonstrate your professionalism. Leaders in online irs afsp tax ce If you are an unenrolled tax return preparer you must complete the 6 hour irs annual federal tax refresher course (aftr) along with your ce to receive an. With the afsp, the irs allows you to demonstrate your skills in completing a basic 1040 tax return. Six (6) hours of credit for the annual federal tax. Lambers’ continuing education courses cover a wide range of content for anyone who works with taxes. Web how do i complete the annual filing season program? Learn more about the afsp here's why you should participate in the annual filing season program. What is mycpe unlimited access? (revised 1/28/21) yes, each record of completion will clearly identify the filing season (calendar year) for which it is valid (e.g., 2021 active year for the 2021 annual filing. Those who choose to participate can meet the requirements by obtaining 18 hours of continuing education, including a six hour federal tax law refresher course with test. Once you have your documentation, follow these steps: Will the afsp record of completion indicate the filing season (calendar year) for which it was issued?

The Annual Filing Season Program YouTube

Everything You Need to Know about the Annual Filing Season Program Blog

The IRS Annual Filing Season Program Explained YouTube

IRS|Annual Filing Season Program (AFSP) Overview YouTube

Best Annual Filing Season Program Courses Reviewed & Rated Beat the

Webinario Annual Filing Season Program YouTube

Everything You Need to Know about the Annual Filing Season Program Blog

Annual Filing Season Program CE Self Study

IRS Annual Filing Season Program IRS Tax CE AFSP CE WebCE

Annual Filing Season Program eBook Horizon Star Academy

Web Your 2021 Tax Return To Access Your Adjusted Gross Income.

#1 Lambers Annual Filing Season Program Course Pros Wide Reaching Content:

What Is The Annual Filing Season Program For Return Preparers?

It Stands For The Irs Annual Filing Season Program.

Related Post: