Cpa Course Requirements California

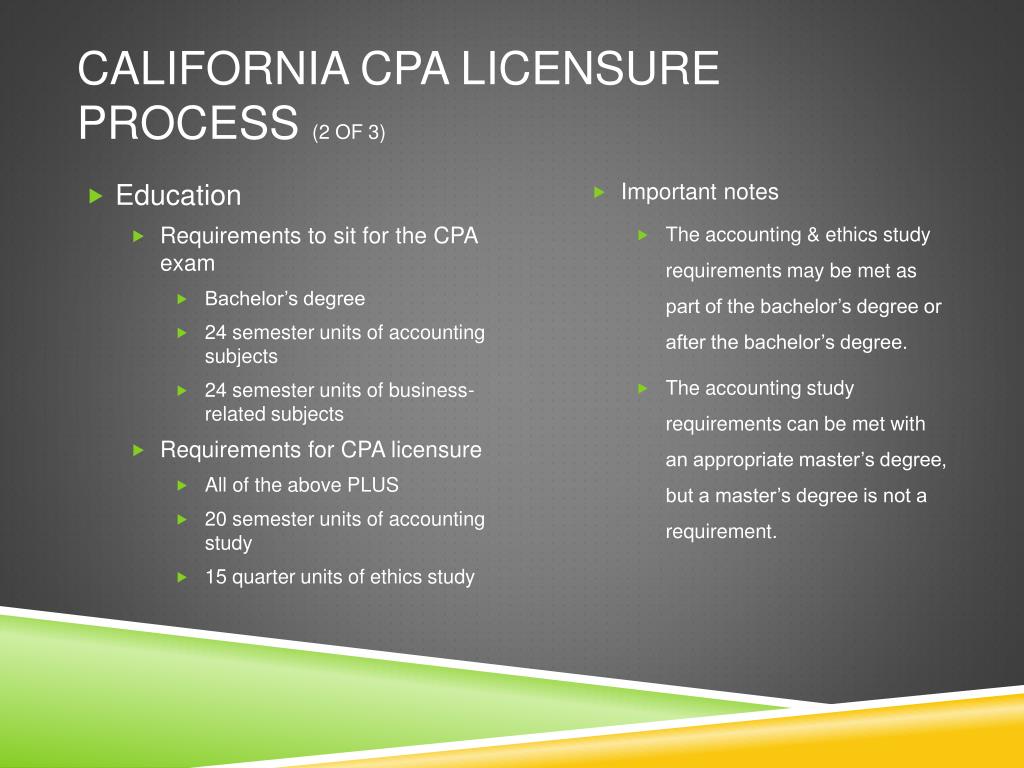

Cpa Course Requirements California - Web cpa exam requirements by state. First, you need to have a bachelor’s degree or higher from an. Varied requirements like passing an ethics exam for several states like california and residency rules like texas and florida mandating 24. To embark on this journey, you should have a bachelor's degree or higher from a recognized educational institution. The educational requirements for california cpas includes a minimum of 150 semester hours of undergraduate work that culminate in a bachelor’s. In addition to the helpful resources below, should you have. Web 2 rows educational requirements to sit for the cpa exam in california; Web welcome to the california board of accountancy (cba) uniform cpa examination (cpa exam) application process. Applicants who want to know the california cpa exam requirements must meet the following educational requirements: Information about cpa licensure information about firm licensure. Search for any california cpa or. The educational requirements for california cpas includes a minimum of 150 semester hours of undergraduate work that culminate in a bachelor’s. Degrees & programs · academic calendar · office of the registrar Web to earn the cpa license in california, you must meet the following requirements: Varied requirements like passing an ethics exam for. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits Web welcome to the california board of accountancy (cba) uniform cpa examination (cpa exam) application process. Web cpa exam requirements by state. According to the cba, the initial 120 credits. Web educational requirements can be completed at community colleges, universities, or other institutions of learning 1 bachelor’s degree or. Information regarding the cpa exam and your. Web california's cpa requirements include a bachelor's degree, 120 credits for the exam, and 150 credits for licensure. Applicants must provide the cba with satisfactory evidence of having completed a minimum of 12 months of general accounting experience. Degrees & programs · academic calendar · office of the registrar The educational requirements for. Web california's cpa requirements include a bachelor's degree, 120 credits for the exam, and 150 credits for licensure. Search for any california cpa or. According to the cba, the initial 120 credits. Identification residency and age exam education experience ethics fingerprinting. Web as a source of reference, please refer to the cba website for detailed information regarding the cpa exam. Web to qualify to take the cpa exam, you must meet the following minimum requirements in order to apply to take the exam: Identification residency and age exam education experience ethics fingerprinting. Web cpa exam requirements by state. Web in order to sit for the cpa exam in california, you must meet a set of education requirements. Web information about. Web as a source of reference, please refer to the cba website for detailed information regarding the cpa exam and your client account. Information regarding the cpa exam and your. Applicants who want to know the california cpa exam requirements must meet the following educational requirements: Web welcome to the california board of accountancy (cba) uniform cpa examination (cpa exam). Information regarding the cpa exam and your. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits Web to qualify to take the cpa exam, you must meet the following minimum requirements in order to apply to take the exam: Web in order to sit for the cpa exam in california, you must meet a set of education requirements.. Web to earn the cpa license in california, you must meet the following requirements: Web information about the cpa exam. Web cpa exam requirements by state. Web welcome to the california board of accountancy (cba) uniform cpa examination (cpa exam) application process. Identification residency and age exam education experience ethics fingerprinting. Web in order to sit for the cpa exam in california, you must meet a set of education requirements. Web educational requirements can be completed at community colleges, universities, or other institutions of learning 1 bachelor’s degree or higher 24 24 semester units in. Applicants must provide the cba with satisfactory evidence of having completed a minimum of 12 months. Information regarding the cpa exam and your. Web in order to sit for the cpa exam in california, you must meet a set of education requirements. To embark on this journey, you should have a bachelor's degree or higher from a recognized educational institution. Web educational requirements can be completed at community colleges, universities, or other institutions of learning 1. Select your state or territory below to learn about the exam and licensure requirements in that jurisdiction. Web as a source of reference, please refer to the cba website for detailed information regarding the cpa exam and your client account. Web information about the cpa exam. Information about cpa licensure information about firm licensure. Web to earn the cpa license in california, you must meet the following requirements: Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits First, you need to have a bachelor’s degree or higher from an. Web cpa exam requirements by state. Web welcome to the california board of accountancy (cba) uniform cpa examination (cpa exam) application process. Web california's cpa requirements include a bachelor's degree, 120 credits for the exam, and 150 credits for licensure. Web to qualify to take the cpa exam, you must meet the following minimum requirements in order to apply to take the exam: Web 2 rows educational requirements to sit for the cpa exam in california; To embark on this journey, you should have a bachelor's degree or higher from a recognized educational institution. Degrees & programs · academic calendar · office of the registrar Web educational requirements can be completed at community colleges, universities, or other institutions of learning 1 bachelor’s degree or higher 24 24 semester units in. Applicants must provide the cba with satisfactory evidence of having completed a minimum of 12 months of general accounting experience.

PPT California CPA licensure education requirements & the Cal Poly

California CPA Exam Requirements 2024 The Crucial Steps

3 CPA Requirements for the Aspiring Public Accountant

Cpa exam requirements california 2018 by mikequlhq Issuu

California CPA Exam Cost The 6 Critical Fees SuperfastCPA CPA Review

California CPA Requirements CPA EXAM and LICENSING Eligibility

Your Guide To Understanding CPA Exam Requirements California

a California CPA determining the 150 unit educational

California CPA Requirements, A CPA Gleim Exam Prep

CPA Requirements by State CpaCredits

Information Regarding The Cpa Exam And Your.

The Educational Requirements For California Cpas Includes A Minimum Of 150 Semester Hours Of Undergraduate Work That Culminate In A Bachelor’s.

In Addition To The Helpful Resources Below, Should You Have.

Varied Requirements Like Passing An Ethics Exam For Several States Like California And Residency Rules Like Texas And Florida Mandating 24.

Related Post: