Credit Risk Management Courses

Credit Risk Management Courses - • understand how companies make financing, payout and risk management decisions that create value • measure the effects of leverage on profitability, risk, and valuation • manage credit risk and financial distress using appropriate financial tools • understand the links. Web this module explains the different risk management concepts with a focus on the various inherent risks in the credit process and the lender's strategies. Web the course will also cover additional topics such as retail credit risk, risk budgeting, and economic capital modelling. Course details get in touch. Web upon successful completion of this course, you will be able to: As such, it remains the most influential regulatory framework for banks, hugely impacting the ways banks manage their risks. Nyif's credit risk and credit analysis professional certificate. You will also get introduced to the various types of financial risks and learn about their sources and how firms manage risks. Web certificate in commercial credit. Credit is not given for fin 537 if the student has received credit for fin 567. Web basel iii is a global regulatory framework adopted by regulators all over the world. Each course in this specialization also fulfills a portion of the requirements for a university of illinois course that can earn you college credit. Web this module explains the different risk management concepts with a focus on the various inherent risks in the credit process. Web online credit risk courses offer a convenient and flexible way to enhance your knowledge or learn new credit risk skills. In this module, you will learn about financial and business risks. Web upon successful completion of this course, you will be able to: Tracy williams sponsored by purple academy 13,668 already. The focus is on statistical techniques used in. The focus is on statistical techniques used in financial risk management rather than risk management practice, cases, or valuation issues. View more you'll walk away with Web this course will introduce you to the credit risk management principles and concepts. This certificate includes seven courses covering the foundational aspects of financial and credit risk management. Principles and concepts in this. Web certificate in financial and credit risk management. As such, it remains the most influential regulatory framework for banks, hugely impacting the ways banks manage their risks. Web this course will introduce you to the credit risk management principles and concepts. • understand how companies make financing, payout and risk management decisions that create value • measure the effects of. Web in this module, we'll cover the principles and concepts of credit risk management. How to build an operational risk assessment program. Principles and concepts in this module, we'll cover the principles and concepts of credit risk management. Web the course will also cover additional topics such as retail credit risk, risk budgeting, and economic capital modelling. Risk management and. Web this course offers you an introduction to credit risk modelling and hedging. Web enterprise risk management (erm) can be a key tool for cooperatives of all sizes to identify warning signs and proactively address potential issues. You will also learn about default trends, market indicators and portfolio management. Nacm's six levels of certification chart your path to earning an. Use statistical models to measure risk associated with different types of investments. Choose from a wide range of credit risk courses offered by top universities and industry leaders tailored to various skill levels. View more you'll walk away with We'll also look at the difference between risk measurement and risk management. Web courses in this program. Web the financial management specialization is part of the university of illinois imba program. In this module, you will learn about financial and business risks. Web course methodology this course utilizes excel models for credit analysis, individual calculation exercises, team activities and plenary discussion. How to build an operational risk assessment program. Nacm's six levels of certification chart your path. The course is designed to hone your skills to shape critical financial outcomes. Frameworks and strategies | coursera business finance credit risk management: Web certificate in financial and credit risk management. Course objectives by the end of the course, participants will be able to: Web as the 2008 financial crisis has shown us, a correct understanding of credit risk and. Identify the key elements of credit risk • understand how companies make financing, payout and risk management decisions that create value • measure the effects of leverage on profitability, risk, and valuation • manage credit risk and financial distress using appropriate financial tools • understand the links. Web courses testimonials what you'll learn understand the concepts and principles of credit. This certificate includes seven courses covering the foundational aspects of financial and credit risk management. Web certificate in commercial credit. Risk management and credit principles. Web this course will introduce you to the credit risk management principles and concepts. Module 2 • 6 hours to complete. Frameworks and strategies this course is part of risk management specialization taught in english 20 languages available some content may not be translated instructors: Credit and credit risk analysis professional certificate examination. The financial risk courses provide principle lessons for understanding and managing interest rate and liquidity risks. Choose from a wide range of credit risk courses offered by top universities and industry leaders tailored to various skill levels. For questions about the program, please contact sps.finance@nyu.edu. Course objectives by the end of the course, participants will be able to: Web the course will also cover additional topics such as retail credit risk, risk budgeting, and economic capital modelling. The course should concern a credit risk impact (for example, the impact of liquidity risk on a commercial customer). Web courses testimonials what you'll learn understand the concepts and principles of credit risk management and the steps to manage portfolio credit risks. The certificate in commercial credit (cicc) leverages moody’s deep expertise in credit assessment and risk management to certify the achievement of the highest standards of credit analysis and decisioning. The course is designed to hone your skills to shape critical financial outcomes.

TRAINING CREDIT RISK MANAGEMENT (FOR BANK) Informasi Training

Credit Risk Management / 9783847323969 / 9783847323969 / 3847323962

Risk management DELFF

Credit Risk Management Diploma Edukite

Credit Risk Management in Banking LDM Risk Management

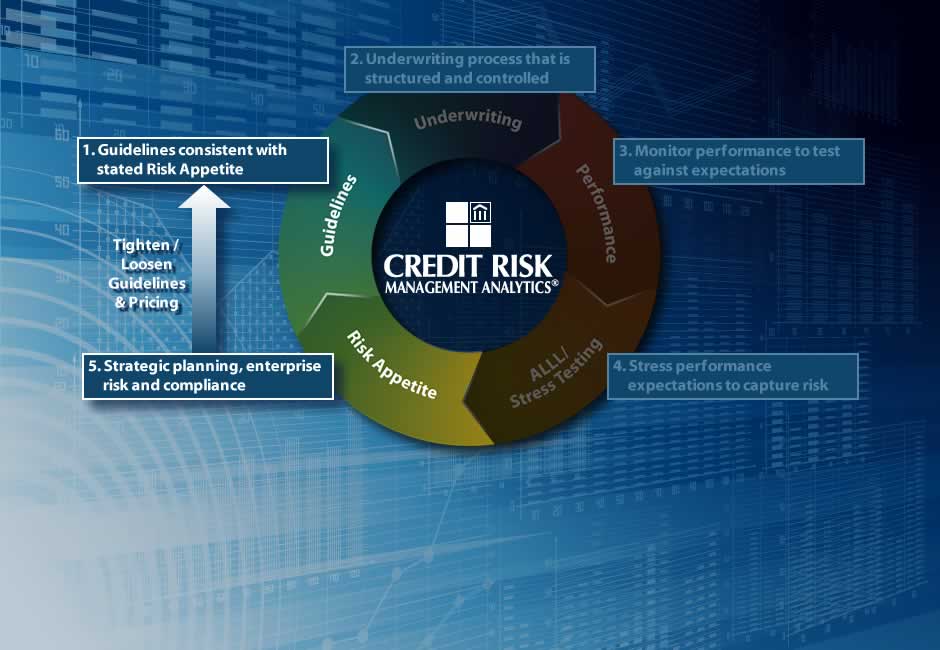

Credit Risk Management A Systematic Process of Identification

😎 Why credit risk management is important. What is the importance of

Credit Risk Management LDM Risk Management

BASIC CREDIT RISK ANALYSIS & MANAGEMENT (Virtual Training) McTimothy

Training Credit Risk Management Daftar Training

Frameworks And Strategies | Coursera Business Finance Credit Risk Management:

Web Basel Iii Is A Global Regulatory Framework Adopted By Regulators All Over The World.

Identify The Key Elements Of Credit Risk

We Will Approach Credit Risk From The Point Of View Of Banks, But Most Of The Tools And Models We Will Overview Can Be Beneficial At The Corporate Level As Well.

Related Post: