Tastytrade Options Course

Tastytrade Options Course - Web stocks / options / futures / and more. Eric villa a weekly roundup of tasty live videos offers the best trading tips from the network’s wealth of financial shows watch these videos to trade options the tastylive way. Discover some of the nuanced differences between futures and other tradable products. From our favorite options strategies to industry terms and phrases, you’ll find just about everything you’ll need right here. Web how to trade options. Contract composition notional value, tick size, expiration, and contract multipliers! Options are contracts between two parties to exchange an underlying asset at a specific price by a certain expiration date. Understand how buying and selling options is different than buying and selling stock. Building an options portfolio portfolio management for any trader is no easy feat. Get the tools and knowledge to take control of your finances. If you're looking to get into derivatives, don't miss this crash course! Options are too risky, they say. Understand how buying and selling options is different than buying and selling stock. By combining long and short options with put and call options, a variety of strategies can be utilized across different market environments. In this course, you'll learn how we. See how options trading can drive your objectives and, in some cases, be more capital efficient. Pricing our revolutionary low rates make for easier trading decisions.* see how we compare against other brokers. Get the tools and knowledge to take control of your finances. Master option pricing to understand tastylive’s trading strategy. On the surface, implied volatility gives us an. By combining long and short options with put and call options, a variety of strategies can be utilized across different market environments. Web options, futures, and futures options are not suitable for all investors. Learn to trade and invest with our educational resources on stocks, options, futures and more. If a scheduling conflict arises, you are free to take a. See how options trading can drive your objectives and, in some cases, be more capital efficient. Well, what is risk anyway? If a scheduling conflict arises, you are free to take a term off and won’t be charged during that term. Understand how buying and selling options is different than buying and selling stock. Once you dig deeper, the answer. Web keep checking back for new content and in the meantime hop over to our help center for more details on account types, trading permissions, and more. By combining long and short options with put and call options, a variety of strategies can be utilized across different market environments. Plus, check out the next crash course on strategy management! From. Web beginner options course if you've already looked into trading options, the first thing you've probably heard is that trading stock is much safer. Pricing our revolutionary low rates make for easier trading decisions.* see how we compare against other brokers. Learn to trade and invest with our educational resources on stocks, options, futures and more. Web enroll for free. Classrooms range in size from a breakout room for 12 to a spacious auditorium that. By combining long and short options with put and call options, a variety of strategies can be utilized across different market environments. In the rolling crash course, you'll learn how to defend options strategies that aren't working in your favor. See how options trading can. Web enroll for free in this course, you will learn about. Options are too risky, they say. Well, what is risk anyway? Eric villa a weekly roundup of tasty live videos offers the best trading tips from the network’s wealth of financial shows watch these videos to trade options the tastylive way. Futures foundations what are the benefits of trading. You deserve a better broker. Web beginner options course if you've already looked into trading options, the first thing you've probably heard is that trading stock is much safer. Web in this beginner's course, we go through the basics of options contracts, the differences between options and stocks, and we take a close look at risk in options trading. Get. You deserve a better broker. Get the tools and knowledge to take control of your finances. Web the course explorer provides the schedule of classes by term and a browsable database of general education requirements in addition to other resources. Learn more * futures trades are $1.25 to open/close. In this course, you'll learn how we can use this information. Well, what is risk anyway? See how options trading can drive your objectives and, in some cases, be more capital efficient. Jim schultz hits all the basic concepts, topics, and strategies that surround the world of options trading. Options trading allows you to build trades based on your risk tolerance, directional assumption, and much more. Discover some of the nuanced differences between futures and other tradable products. Classrooms range in size from a breakout room for 12 to a spacious auditorium that. You deserve a better broker. Specifically, you'll see how to improve your cost basis, give your trades more time to be right, and do so for both defined and undefined risk positions. Some additional applicable fees will be charged on both opening and closing trades for all products. Do you know what liquidity, implied volatility, probability of profit, and extrinsic value mean? Eric villa a weekly roundup of tasty live videos offers the best trading tips from the network’s wealth of financial shows watch these videos to trade options the tastylive way. Pricing our revolutionary low rates make for easier trading decisions.* see how we compare against other brokers. Options are too risky, they say. In this options course, you’ll learn about: Building an options portfolio portfolio management for any trader is no easy feat. Master option pricing to understand tastylive’s trading strategy.

tastytrade Review The tastytrade Options Strategy

tastytrade Tutorials The Trade Tab (InDepth Guide) YouTube

Unlocking Covered Calls with tastytrade Options Strategy Series YouTube

Adjusting option order quantity tastytrade

tastytrade Options Trading Demonstration YouTube

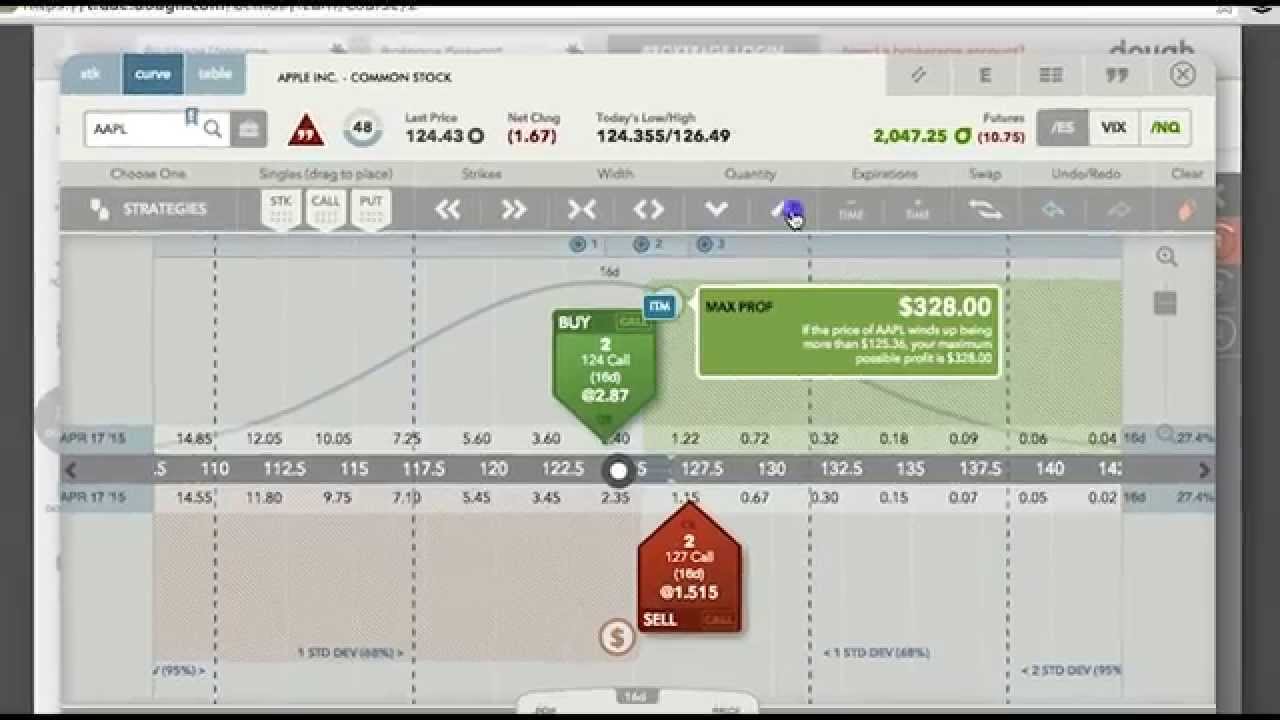

Options Trading With Dough & Tastytrade YouTube

How to buy or short stock on tastytrade tastytrade

Analysis mode on the tastytrade desktop platform tastytrade

Options Crash Course tastytrade

Tastytrade Review Pros & Cons for 2023

Web Options, Futures, And Futures Options Are Not Suitable For All Investors.

Learn To Trade And Invest With Our Educational Resources On Stocks, Options, Futures And More.

Web How To Trade Options.

Contract Composition Notional Value, Tick Size, Expiration, And Contract Multipliers!

Related Post: