Tax Credit Courses

Tax Credit Courses - Web the low income housing tax credit (lihtc) is an important resource for creating affordable housing in the united states today. Web more than 1,000 credit courses are offered each semester in more than 200 career and technical programs. Trainings should be as entertaining as they are educational—not a dreaded bore. It covers and focuses on the u.s. Federal taxation of individuals & businesses. Web enroll in h&r block’s virtual tax preparation course to master your return or start a career. Federal tax system and how it impacts individuals, employees, and sole proprietors. Understanding the rules and staying on top of the changes to household eligibility, property inspections, tenant files and rent, and documentation is challenging. Many of the state allocating / compliance agencies either recommend or require this training. To date more than 3 million apartment units have been created through lihtc with another 100,000 new units added each year. You'll be exposed to the u.s. The trainings offered through this exciting new partnership feature an exclusive discounted registration rate for nahro members. Web more than 1,000 credit courses are offered each semester in more than 200 career and technical programs. With natsuki hanae, kengo kawanishi, akari kitô, yoshitsugu matsuoka. C3p has been offered in all 50 states, puerto rico. (excluding returns that include child tax credit or earned income credit combined with interest and dividend forms) compared to turbotax. To date more than 3 million apartment units have been created through lihtc with another 100,000 new units added each year. Web edge2learn provides access to the best resources available for your lihtc training program with our partnership with karen. Enrollment is open to all—from undergrads to high school students*, professionals, alumni, and any interested adult. Tanjiro undergoes rigorous training with the stone hashira, himejima, in his quest to become a hashira. Federal tax system as it relates to individuals, employees, and sole proprietors. It will clarify the complicated compliance world as only nchm can. Small business jobs tax act; Roughly half of these credits come from general education courses like a foreign language, history, english and science. Different people learn best in different ways and, now, you get to choose. A $1.99 bundle that allows you to top off your wallet with 150 credits if you're just short. Cornell university summer session offers hundreds of regular cornell courses taught. Live and reccorded webinars are available. Meanwhile, muzan continues to search for nezuko and ubuyashiki. The trainings offered through this exciting new partnership feature an exclusive discounted registration rate for nahro members. Web the low income housing tax credit (lihtc) is an important resource for creating affordable housing in the united states today. Roughly half of these credits come from. To date more than 3 million apartment units have been created through lihtc with another 100,000 new units added each year. Different people learn best in different ways and, now, you get to choose. Web in most cases, you’ll need to complete 120 credits to earn your degree. Web gaap accounting for tax credits; Web tab over to the super. C3p has been offered in all 50 states, puerto rico and the us virgin islands, since 1990. You will work with your advisor to ensure that your graduation plan includes courses required to earn your degree at uw. Different people learn best in different ways and, now, you get to choose. (excluding returns that include child tax credit or earned. Web the low income housing tax credit (lihtc) is an important resource for creating affordable housing in the united states today. It covers and focuses on the u.s. Live and reccorded webinars are available. Web the c3p course will benefit all management personnel, owners, syndicators, asset managers, and state agency staff who deal with the low income housing tax credit.. Cornell university summer session offers hundreds of regular cornell courses taught by outstanding university faculty members. Web gaap accounting for tax credits; Learners will develop knowledge in u.s. A $1.99 bundle that allows you to top off your wallet with 150 credits if you're just short. Small business jobs tax act; Web the c3p course will benefit all management personnel, owners, syndicators, asset managers, and state agency staff who deal with the low income housing tax credit. Web in most cases, you’ll need to complete 120 credits to earn your degree. Also, 40 percent of the credit for which you qualify that is more than the tax you owe (up to.. (excluding returns that include child tax credit or earned income credit combined with interest and dividend forms) compared to turbotax. With our comprehensive tax classes, courses, and training program, you’ll be preparing taxes like a pro. You'll be exposed to the u.s. Cornell university summer session offers hundreds of regular cornell courses taught by outstanding university faculty members. To date more than 3 million apartment units have been created through lihtc with another 100,000 new units added each year. Tcs provides a thorough review of irs regulations and guidance, including the irs’s guide for completing form 8823. Federal tax system as it relates to individuals, employees, and sole proprietors. With natsuki hanae, kengo kawanishi, akari kitô, yoshitsugu matsuoka. Trainings should be as entertaining as they are educational—not a dreaded bore. You will work with your advisor to ensure that your graduation plan includes courses required to earn your degree at uw. C3p tax credit and star rd 515 seminars will include all of these updates as well. Web the c3p course will benefit all management personnel, owners, syndicators, asset managers, and state agency staff who deal with the low income housing tax credit. Tax credits and the federal budget; Live and reccorded webinars are available. Federal taxation of individuals & businesses. It covers and focuses on the u.s.

Education tax credits and deductions IRS Free File Program delivered

Best Tax Prep Courses

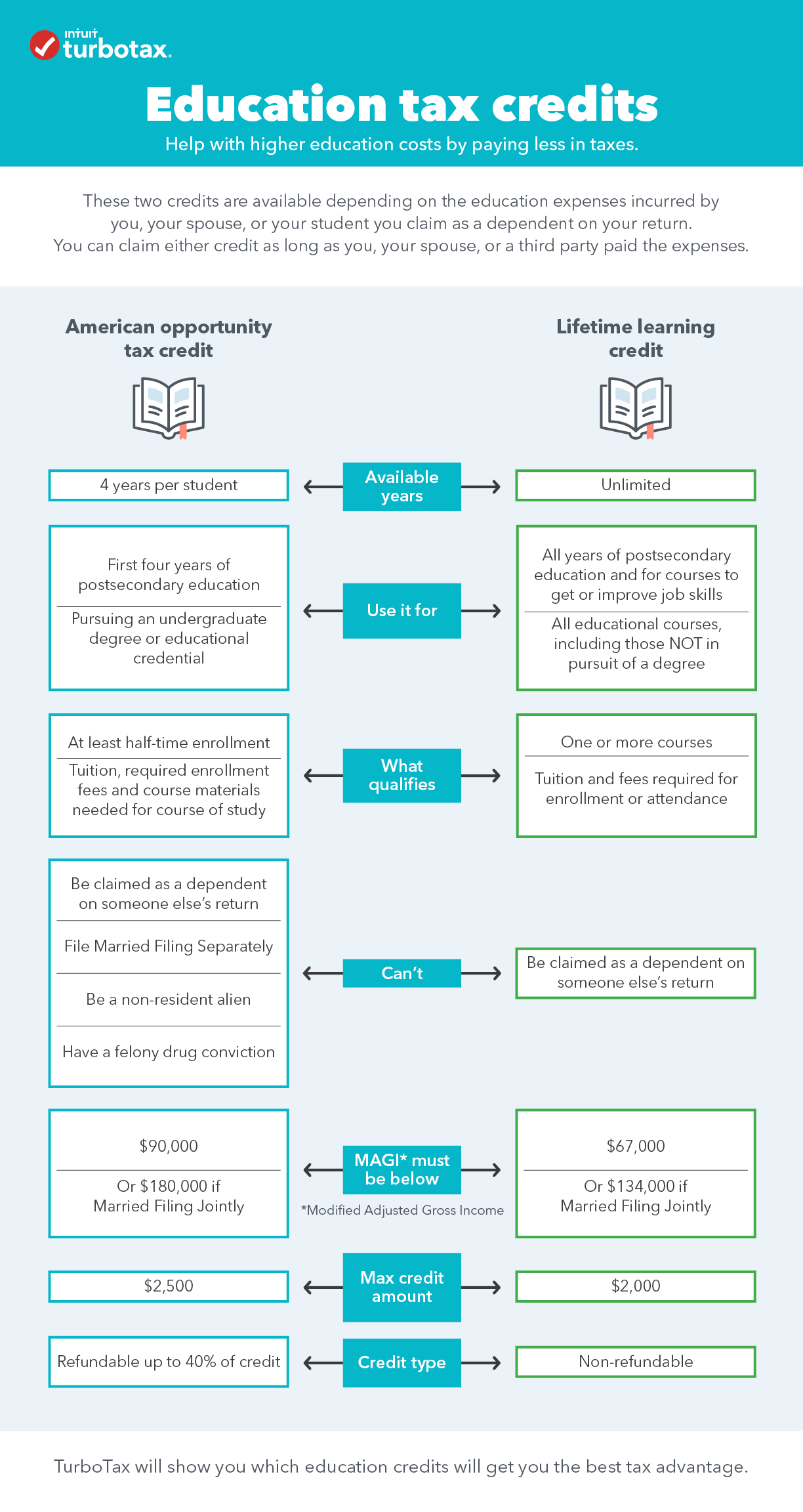

The Comprehensive Guide to Education Tax Credits TaxSlayer®

Best Free Online Tax Courses

and PTE TAX 2022-500x500.jpg)

Employee Retention Credit (ERC) & PTE Tax 20022 Mini Course American

6 Best Tax Accounting Courses Online IIM SKILLS

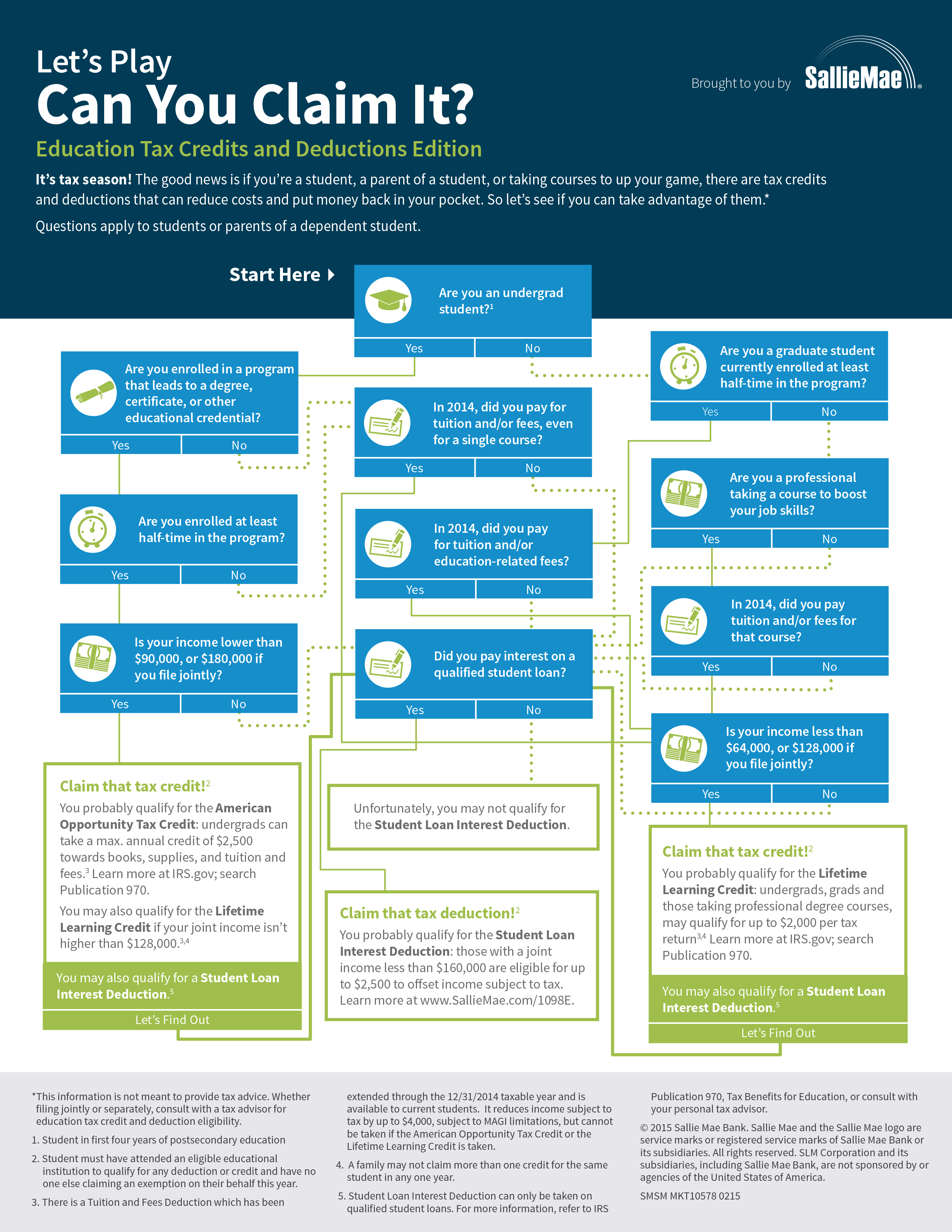

Education Tax Credits and Deductions Can You Claim It?

Comprehensive Tax Course The Tax School

International Taxation and Foreign Tax Credit

Tax Preparation Course sts1stoptaxtraining

Web Tab Over To The Super Credits Currency Page And You'll Find Another Small Surprise:

Taught In English 20 Languages Available Some Content May Not Be Translated Instructors:

Ecfs 301 Early Childhood Curriculum (5.

Tanjiro Undergoes Rigorous Training With The Stone Hashira, Himejima, In His Quest To Become A Hashira.

Related Post: